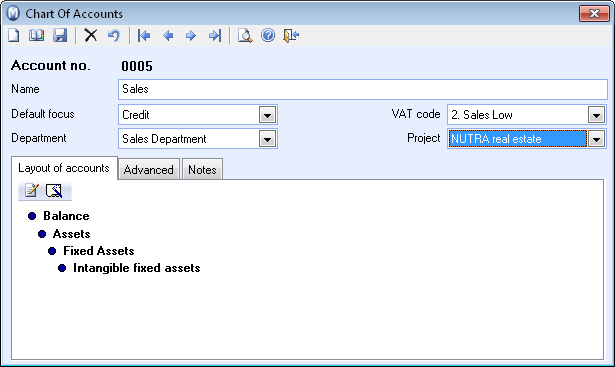

Chart of Accounts Properties

View - Accounting -

Chart of Accounts ![]()

The toolbar in the Chart of Accounts window

![]() Click New to create a new N/C.

Find out more in How to add a new N/C to the Chart of Accounts.

Click New to create a new N/C.

Find out more in How to add a new N/C to the Chart of Accounts.

![]() Click on List to open a list of

all the registered N/Cs.

Click on List to open a list of

all the registered N/Cs.

![]() For a better overview you can Delete the N/Cs you do not use. However,

certain N/Cs cannot be deleted because they are control accounts. These

accounts are used for automatic posting in different program modules.

For a better overview you can Delete the N/Cs you do not use. However,

certain N/Cs cannot be deleted because they are control accounts. These

accounts are used for automatic posting in different program modules.

![]() Note! We do not recommend that any

accounts are deleted, but that they are instead set to No

Access and Don’t Show in Advance.

This will hide them from the account lists.

Note! We do not recommend that any

accounts are deleted, but that they are instead set to No

Access and Don’t Show in Advance.

This will hide them from the account lists.

![]() Click on Preview for an overview

of the chart of accounts in report form. The preview is printable.

Click on Preview for an overview

of the chart of accounts in report form. The preview is printable.

![]() Tip! You can also print the report

via the Report Module. To do so, go to File

- Print, enter the Accounting

section and select the Chart

of Accounts, Nominal list report.

Tip! You can also print the report

via the Report Module. To do so, go to File

- Print, enter the Accounting

section and select the Chart

of Accounts, Nominal list report.

Field in the Chart of Accounts window

Default focus helps you make journal entry more efficient. If you register a journal item in journal entry, the setting will guide you to the correct field. Debit is commonly used for expenses and Credit for revenues.

VAT code: When an account is linked to a VAT code, VAT will always be calculated when the transaction is registered against the account in the Journal entry. By default, VAT is deducted from the amount and set aside in a tax account that is specified for the VAT code that you select here. You can also select to register the basis for VAT as a net amount. Then the VAT will be added instead of deducted. These settings can be created in the User Settings for Journal Entry.

![]() Note! In the Company

settings you can specify whether the company is VAT

exempt or not. If you select No

VAT/VAT exempt, you will be asked if you want to change the VAT

codes for all accounts to "None". If your company is VAT exempt,

you are recommended to click Yes.

If you click No, direct journal

entries made in the The Journal Entry Window, will still be calculated with VAT since the setting only affects the VAT calculations for indirect transaction accounting via the Sales/Invoicing and Purchase Order modules.

Note! In the Company

settings you can specify whether the company is VAT

exempt or not. If you select No

VAT/VAT exempt, you will be asked if you want to change the VAT

codes for all accounts to "None". If your company is VAT exempt,

you are recommended to click Yes.

If you click No, direct journal

entries made in the The Journal Entry Window, will still be calculated with VAT since the setting only affects the VAT calculations for indirect transaction accounting via the Sales/Invoicing and Purchase Order modules.

If you selected No VAT/VAT exempt when you created the company database, you can later change the VAT code for all accounts to "None". Select Registered and then No

VAT/VAT exempt in order to be prompted.

If you want the journal entries linked directly to a Project and/or Department you can apply default settings for this on the account. The account entries will automatically be entered to the Project or Department that you have specified.

![]() Tip! If you have several company databases you can manage the chart of accounts with the help of the

Company Handling function. You will find this function under

File - Database Utilities.

Find out more about Company Handling in a separate section

here.

Tip! If you have several company databases you can manage the chart of accounts with the help of the

Company Handling function. You will find this function under

File - Database Utilities.

Find out more about Company Handling in a separate section

here.

Tabs in the Chart of Accounts window

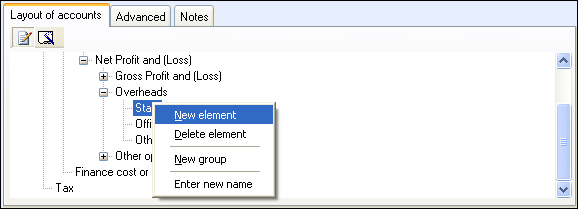

Layout of accounts

![]() Click Change

layout of accounts to edit the order of the N/Cs. By right-clicking

the category that you wish to edit, you can edit, delete or enter a new

name.

Click Change

layout of accounts to edit the order of the N/Cs. By right-clicking

the category that you wish to edit, you can edit, delete or enter a new

name.

![]() You can click Suggest layout of accounts

to reset the layout of accounts to the program's default suggestion.

You can click Suggest layout of accounts

to reset the layout of accounts to the program's default suggestion.

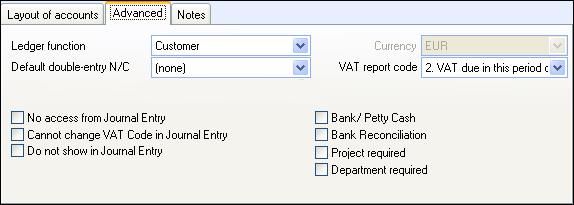

Advanced

Ledger function: From the drop-down list you can select between Customer or Supplier. Entries to an N/C with a customer and supplier ledger function will generate an item in the customer and supplier ledger. Entries against this N/C will automatically be suggested for payment entry in the contra account set as the Default double entry N/C. For example, by entering 1230 Petty cash as the Default double entry N/C for 0030 Office equipment you will avoid having to enter 1230 as the contra account when you manually enter journal items.

Default double entry N/C: If

you always want a default double-entry N/C towards this account, select

the default

double-entry N/C from the drop-down list. For example, by entering 1230

Petty Cash as the Default double-entry

N/C for account 7505 Office Stationary you avoid having to enter

1230 as the double-entry N/C when manually posting in the Journal Entry.

Currency: Select the currency (only balance sheet accounts)

VAT report code: VAT report code shows which 'box' on the VAT return the journal entry line will be reported to.

Select one of the boxes if you would like to make use of these functions for the current N/C:

No access from Journal Entry: Sets the account to Inactive so that it cannot be used in Journal Entry.

Cannot change VAT Code in Journal Entry: If this is selected, you cannot override the default VAT code during Journal Entry.

Do not show in Journal Entry: Not shown in the journal list that is used in the opening page of Journal Entry. It is still possible to enter journals for the account by typing the account number directly into the journal.

Bank/Petty Cash: The accounts associated with Bank/Petty Cash will form the basis for calculating future cash flow. Read more about this in Future Cash Flow. The balance of the Bank/Petty Cash accounts will also be displayed in the journal entry module if you have activated the setting View bank account balances in the user settings for journal entry. If you have more than nine accounts of this type, only the nine accounts with the lowest account numbers will be displayed.

![]() Tip! By going

to Journal Type and number series

in the accounting settings, you can limit the journal types, for example,

by defining that certain journal types cannot be linked to Bank/Petty

Cash accounts, or that they cannot be linked to several different

accounts of this type simultaneously. Read more in Journal Type Settings and Number Series.

Tip! By going

to Journal Type and number series

in the accounting settings, you can limit the journal types, for example,

by defining that certain journal types cannot be linked to Bank/Petty

Cash accounts, or that they cannot be linked to several different

accounts of this type simultaneously. Read more in Journal Type Settings and Number Series.

If you tick this box and also set limitations for the Journal types, the system will restrict journal entries for this account. Find out more about the limits for journal types in Journal Type Settings and Number Series.

Bank Reconciliation: Tick this box if you wish to use the Bank reconciliation functionality to reconcile this account. Find out more in Bank Reconciliation.

Project required: Check this box if you want to make it a requirement to enter a project when using the account.

Department required: Check this box if you want to make it a requirement to enter a department when using the account.

![]() Note! Consistency is vital for keeping

your accounts accurate. The account name alone may not suffice when explaining

what the N/C is used for. Therefore, you have the opportunity to give

a more detailed description in the Note

tab. You can also add this to existing N/Cs.

Note! Consistency is vital for keeping

your accounts accurate. The account name alone may not suffice when explaining

what the N/C is used for. Therefore, you have the opportunity to give

a more detailed description in the Note

tab. You can also add this to existing N/Cs.

Read more about: