Accounting Periods and Years

Mamut Business Software has 13 accounting periods. Periods 1 to 12 are the twelve months of the year, whilst period 13 is used for making Year End adjustments.

The Accounting module is created so that the user has the most possible flexibility when starting a new accounting year. This means that you are not required to do anything in particular to make use of the system for the new accounting year other than creating it (if you have not yet done so). See below to find out how the different modules decide which accounting year entries are made into.

Below you can find out how the different modules determine the accounting year which a post is entered in.

It is usually necessary to continue making entries in the previous accounting year, even though you are now in your new accounting year. The reason for this is that there will always be a slight delay in administrative routines, i.e. goods that were delivered at the end of March are usually invoiced a few days into April, etc. Besides, you rarely post year end entries until a little into the following year but this should not prevent you from making daily entries and continuing as usual. You cannot risk having to postpone entries for the new accounting year until the previous year’s Year End is complete. In Mamut we solve this by changing the active accounting year in the Accounting settings or in Journal Entry. This allows more room for Year End, at the same time as entries for the current accounting year are not being ignored.

The accounting year is considered closed when all items are in place and the previous year's closing balance is transferred as the opening balance for the new accounting year. After Year End is complete, it is no longer possible to enter or amend entries for the previous year. Should anything appear that you want included in these accounts, your only option is to include it as a corrective entry in the current year’s accounts.

Sales and Invoicing Module

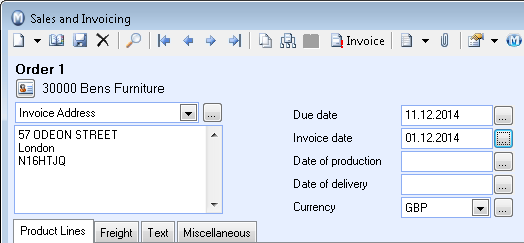

In Mamut Business Software it is possible to control which period (date) an invoice will be entered in by selecting the invoice date in the Invoice date field in the Sales and Invoicing module. The date that is entered here decides which period the invoice is entered in. If you do not use an invoice date the program date will be used.

The Purchase Module

In the Purchase Module the invoice date when posting an item determines which period and accounting year the purchase is posted in.

Journal Entry

In Journal Entry you are free to select the accounting year and period. You still have the option to make entries for the previous year in periods that are not closed. If period 12 of the previous year has been closed, you will only be able to make entries for period 13 of that accounting year.

Journal number series start at no. 1 in a new accounting year

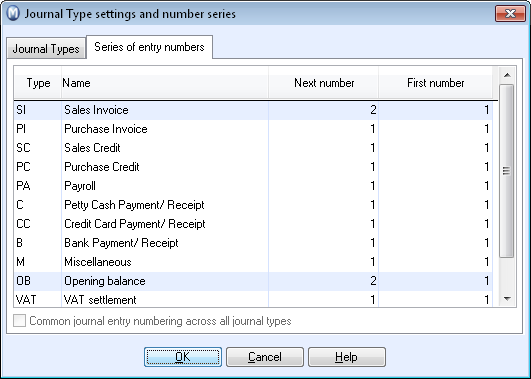

In Mamut it is common that each journal type has its own number series. Each number series starts with no. 1 every year unless you override this manually before you start making any journal entries.

You will find the Journal number series settings by selecting View - Settings - Accounting - Accounting settings and then Journal type settings and number series.

![]() Important! These settings must be completed

before you start using Sales/Invoicing

and Journal Entry in the new accounting year. This also applies when you

mark the Common number series for all

journal types check box.

Important! These settings must be completed

before you start using Sales/Invoicing

and Journal Entry in the new accounting year. This also applies when you

mark the Common number series for all

journal types check box.

Other number series

Number series for e.g. Sales number, Invoice number and Customer number will continue where they ended the previous year. In other words, these number series will not be reset. The reason for this is that these registers do not have a clear definition per year as do the accounts.

Period 13 and Year End entries

After period 12 in the previous year is closed, the next period you can make entries on is period 13. This period automatically closes when you complete the Year End for that year.

The main reason for an accounting system to have 13 periods is that most users do not want to complete Year End until well into a New Year.

The most important entries in period 13 are items that are time limited (accrual accounting, warehouse estimates, allocations etc) as well as allocating profit/loss. In these cases most people use traditional Year End programs with their accountant (if they prefer that).

If you enter journals with VAT in period 13, you must remember to enter

the VAT manually in the settlement account for VAT, so that opening balances

in the next accounting year are correct.

When entering journal entry information relating to an accounting year in which periods 1 to 12 have been closed, the system will display two messages if Date and period control has been selected in the user settings for Journal Entry.

Click OK in the window when you get the warning that the program Cannot find associated period.

Click OK when the warning The date is outside the period chosen on the journal entry appears and continue with the journal entry in the usual manner.

Read more about: