Editing the VAT Codes

View - Settings - Accounting

- Accounting Settings - Maintenance of VAT rates ![]()

![]() Editing VAT codes is limited to editing or duplicating existing codes.

In addition, the majority of settings in the VAT code window will be locked

for changes; however, you will find that the current VAT codes cover most

purposes.

Editing VAT codes is limited to editing or duplicating existing codes.

In addition, the majority of settings in the VAT code window will be locked

for changes; however, you will find that the current VAT codes cover most

purposes.

![]() You can edit some of an existing VAT code's settings by going to the VAT

code register, selecting the relevant VAT code from the list, and then

clicking Edit.

You can edit some of an existing VAT code's settings by going to the VAT

code register, selecting the relevant VAT code from the list, and then

clicking Edit.

![]() If you wish to duplicate a VAT code then simply select the relevant code

from the list, and click New.

If you wish to duplicate a VAT code then simply select the relevant code

from the list, and click New.

![]() Tip! If your business was not liable

to pay VAT previously, you can change this under View

- Settings - Company - Financial Settings. You will then also have

to set VAT codes for accounts in the Chart of Accounts that are liable

for taxation.

Tip! If your business was not liable

to pay VAT previously, you can change this under View

- Settings - Company - Financial Settings. You will then also have

to set VAT codes for accounts in the Chart of Accounts that are liable

for taxation.

By editing a VAT Code, which controls the position of the code in the list, you can adjust the order in the list for selections in other modules. This makes it easier to access the VAT codes you use most often.

The Description may also be changed if you want to indicate more clearly what the individual code will be used for.

You will find a more detailed explanation of the different fields in the VAT Code window in Editing the VAT codes.

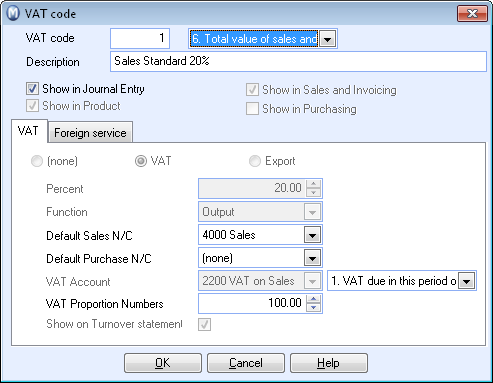

Main window

VAT Code: Denominates the VAT type's place in the list. By changing the code you can adjust the order in the list for selections in other modules. This makes it easier to access the VAT codes you use most often.

Description: Can be changed if you want to indicate more clearly what the individual code will be used for.

Show in Journal Entry: Whether the code will display as an option in Journal Entry.

Show in Product: Whether the code will be linked to a sales product.

Show in Sales and Invoicing: Whether the code will be used in the Sales/Invoicing module.

Show in Purchasing: Whether the code will be used in the Purchase module.

The VAT tab

The top three fields (None), VAT and Export indicate whether the code is a VAT code or not. (Export does not have a VAT code, only because it is Export)

Percent: Indicates the percentage rate used for calculating VAT. In United Kingdom this is 20%.

Function: Can be Input or Output. Sales are 'Output VAT' and Purchases are 'Input VAT'.

Default Sales N/C: This account will always be credited when invoicing products with this VAT code. The exception is if a different Sales N/C has been specified for the product being sold.

Default Purchase N/C: This account is always debited on entering purchases with this VAT code. If your program version contains Logistics functionality the account can be changed when posting a purchase. There are also individual settings at product level that will override the default cost account.

VAT Account: This is the account into which the VAT amount is entered in the balance sheet.

VAT Proportion Numbers: Are used by companies with operations that are partially VAT exempt and partially VAT liable. For joint purchases, a percentage distribution is used, indicating how much of the price of a product is to be included in the VAT calculation.

Show on Turnover statement: This option should always be selected.

This applies to program versions not including Accounting, where you can extract a turnover statement. Here you choose whether the code is to be included on the statement.

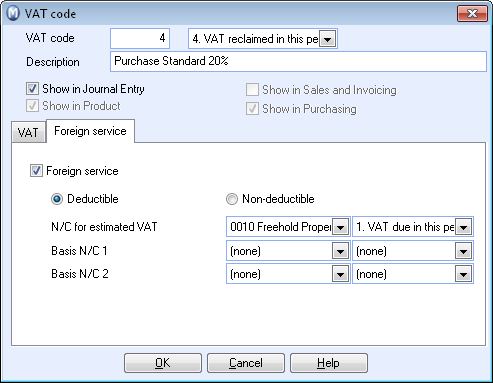

Foreign Service: If this setting is selected, services purchased from abroad will be tax-processed. Read more in VAT on services from abroad.

Deductible/Non-deductible: Determines whether taxes paid on services purchased abroad are to be deducted.

N/C for estimated VAT: This is the N/C under which the tax is entered on the balance sheet.

Basis N/C 1: This is the N/C against which the VAT base for the calculation is entered.

Basis N/C 2: This is the N/C against which the VAT base is balanced (to make the journals balance).

![]() Tip! Amounts

entered into an account with a VAT code set as a Foreign

service are always entered as net, even if the option Enter

amount without VAT (net) has been activated in the user settings

for journal entry.

Tip! Amounts

entered into an account with a VAT code set as a Foreign

service are always entered as net, even if the option Enter

amount without VAT (net) has been activated in the user settings

for journal entry.

Read more about: