Cash VAT

View - Settings - Accounting

- Module settings - Cash VAT ![]()

All transactions such as raising invoices, posting purchase invoices, cash-transactions, posting payments and VAT will be calculated and transferred to the system's VAT-return as per the accepted Cash VAT accounting principles.

Please note that the system will only allow a change between Cash VAT and Standard VAT from the beginning of a VAT period which has no postings. If postings have been made, the VAT scheme can be changed in the next VAT period that does not contain any postings.

Changing VAT accounting methods

-

Select View - Settings - Accounting.

-

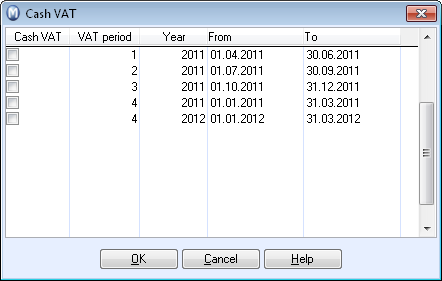

Click Cash VAT in the Module Settings tab.

-

Untick the first dateline from which the new VAT accounting method will be used. The following periods will be updated automatically according to your selection.

![]() You have now changed the VAT accounting method.

If you want to reverse the VAT accounting method with a later period,

just change the first dateline with the changed VAT accounting method.

The following datelines will be updated automatically.

You have now changed the VAT accounting method.

If you want to reverse the VAT accounting method with a later period,

just change the first dateline with the changed VAT accounting method.

The following datelines will be updated automatically.

![]() Tip! When creating a new accounting

year, by selecting the check-box Inherit

cash VAT settings, you can decide if these user-defined VAT accounting

settings for the current accounting year are to be transferred to the

new accounting year. Read more here.

Tip! When creating a new accounting

year, by selecting the check-box Inherit

cash VAT settings, you can decide if these user-defined VAT accounting

settings for the current accounting year are to be transferred to the

new accounting year. Read more here.

![]() Note! The method of entering opening

balances for Cash VAT is different to normal VAT method. Read

more here.

Note! The method of entering opening

balances for Cash VAT is different to normal VAT method. Read

more here.

Read more about: