Managing your Accounting Rules

Accounting rules are the tests which Mamut Validis

applies to your accounting data to examine the basic logical accounting

principles that should be evident in your accounts. These are designed

to ensure that your financial statements are properly constructed, and

that only expected behaviour is recorded for each transaction. Examples

might include checking that an account closes in the correct position;

checking that purchase and sales transactions are recorded in the correct

accounts; and ensuring that there are no unexpected debit or credit entries

in accounts where they should not be. Mamut Validis

reports any breaches of these rules as potential anomalies and groups

them according to the relative importance of the rule.

Mamut Validis has hundreds

of accounting rules which are applied against every nominal code in your

data. They provide what can be thought of as a "sanity check"

of every single transaction in the data. The rules apply to either the

Balance Sheet items, the Profit and Loss items or both. Amongst other

things, the accounting rules ensure:

Accounts close in the

correct position. For example, that the Sales account is in a credit position,

so as to represent the income of a company; and that the Expenses account

is in a debit position, to reflect the costs to the company; and so on.

Accounts that are collection

buckets for transactions collect only the expected debit or credit entries.

For example, that Capital and Reserves contain no debit entries; that

Sales does not contain debit entries that may reduce the income position

for tax purposes; and so on.

Accounts do not contain

any unexpected transaction types, so as to ensure the correct 'filing'

of transactions, and that there are no mis-statements of key lines in

the Profit and Loss statement. For example, Purchases and expense accounts

should only contain purchase transaction types, and Sales and income accounts

should only contain sales transactions.

If your accounting data fails any of these tests, Mamut Validis

identifies the offending transactions, or groups of contributory transactions,

as potential anomalies and reports them as part of its analysis. The Accounting Rules screen displays a list

of the Mamut Validis accounting

rules, and allows you to select the rule you want to work on.

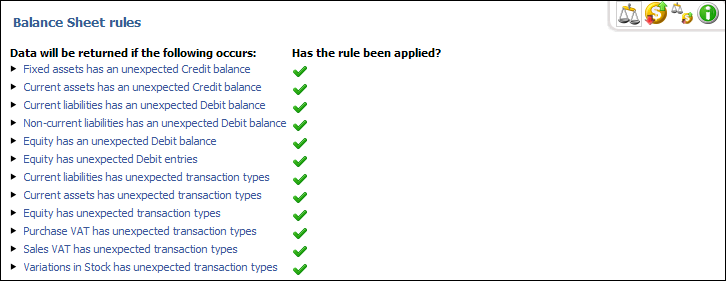

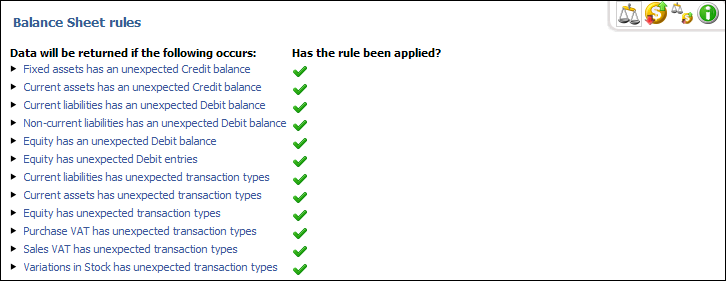

How to edit an accounting rule

Select the menu option Configuration

- Accounting Rules Editor. The

Accounting Rules screen is displayed;

initially showing a list of the rules that apply to your Balance Sheet.

The rules that are currently being applied to your accounting data are

indicated by a tick; those which you have switched off and which are not

being applied are shown with a cross.

If appropriate, use the buttons at the top-right of

the screen to change the rules being displayed, as follows:

.View Balance Sheet: Displays the rules

that only apply to your Balance Sheet.

.View Balance Sheet: Displays the rules

that only apply to your Balance Sheet.

.View

Profit and Loss: Displays

the rules that only apply to your Profit and Loss.

.View

Profit and Loss: Displays

the rules that only apply to your Profit and Loss.

.Both Balance Sheet and Profit and Loss: Displays the rules that apply to both

your Balance Sheet and Profit and Loss.

.Both Balance Sheet and Profit and Loss: Displays the rules that apply to both

your Balance Sheet and Profit and Loss.

Click on the trend rule you wish to edit.

Choose to either Enable

or Disable the rule by checking

the appropriate box.

Set level of importance

from the drop-down list by choosing Low,

Medium or High.

Set rule frequency

to either monthly, quarterly

or annually through the drop-down

menu.

Select accounts

you would like the rule to be applied to, by checking the appropriate

boxes.

Click Apply

to approve the changes and finish editing the rule.

You have now selected the accounting rules

for editing.

You have now selected the accounting rules

for editing.

Read more about:

Profile Details

The Analysis Reports

Summary Dashboard

The Accounting Rules

Report

Managing your Trend

rules

.

. .

.

You have now selected the accounting rules

for editing.

You have now selected the accounting rules

for editing.