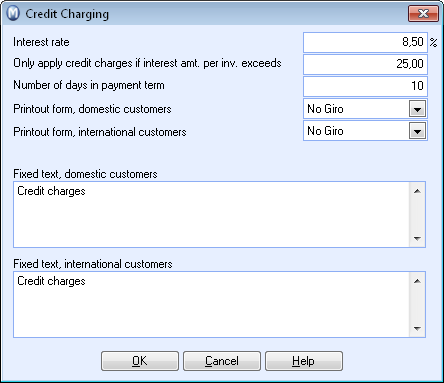

Settings for Credit Charging

View - Settings - Accounting

- Customer & Supplier Ledger ![]()

Lost interest income due to customers who make late payments can reach a significant amount in the course of the year. In Credit Charging settings you can define the settings for invoicing your customers who have made late payments.

You can make the following settings:

Interest rate: Here you decide the interest rate that will be used for customers who pay after the due date.

![]() Tip! Rates for calculating interest

are fixed for defined periods. Please refer to the relevant laws and regulations

regarding charging interest for your country. For more information regarding

calculating the correct interest rate, refer to this website: http://www.payontime.co.uk/legislation/legislation_main.html

Tip! Rates for calculating interest

are fixed for defined periods. Please refer to the relevant laws and regulations

regarding charging interest for your country. For more information regarding

calculating the correct interest rate, refer to this website: http://www.payontime.co.uk/legislation/legislation_main.html

Only apply credit charges if interest amount per invoice exceeds: Select an amount limit for when credit charging is applied.

Number of days in payment term: Here you decide within how many days your customers will have to pay the credit charges.

Printout form, domestic customers: Here you decide the printout form to be used when applying credit charges to domestic customers. This field only applies to separate credit charge invoices.

Printout form, international customers: Here you decide the printout form to be used when applying credit charges to international customers. This field only applies to separate credit charge invoices.

Fixed text, domestic customers: Fixed text that is entered here will appear on all credit charges to domestic customers. This field only applies to separate credit charge invoices.

Fixed text, international customers: Fixed text that is entered here will appear on all credit charges to international customers. This field only applies to separate credit charge invoices.

Read more about: